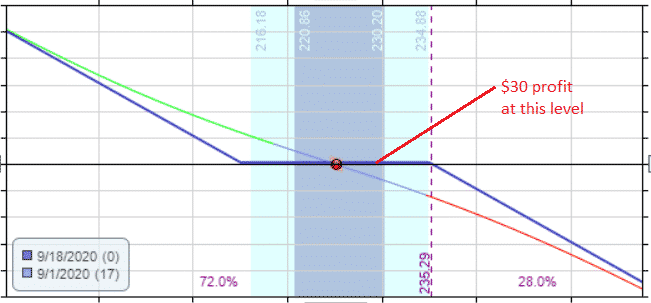

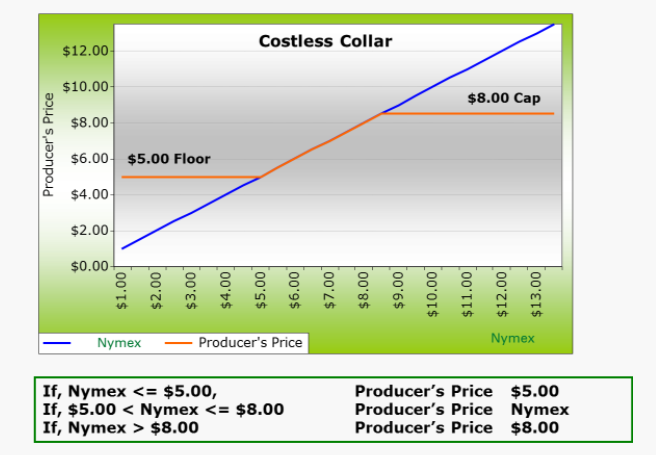

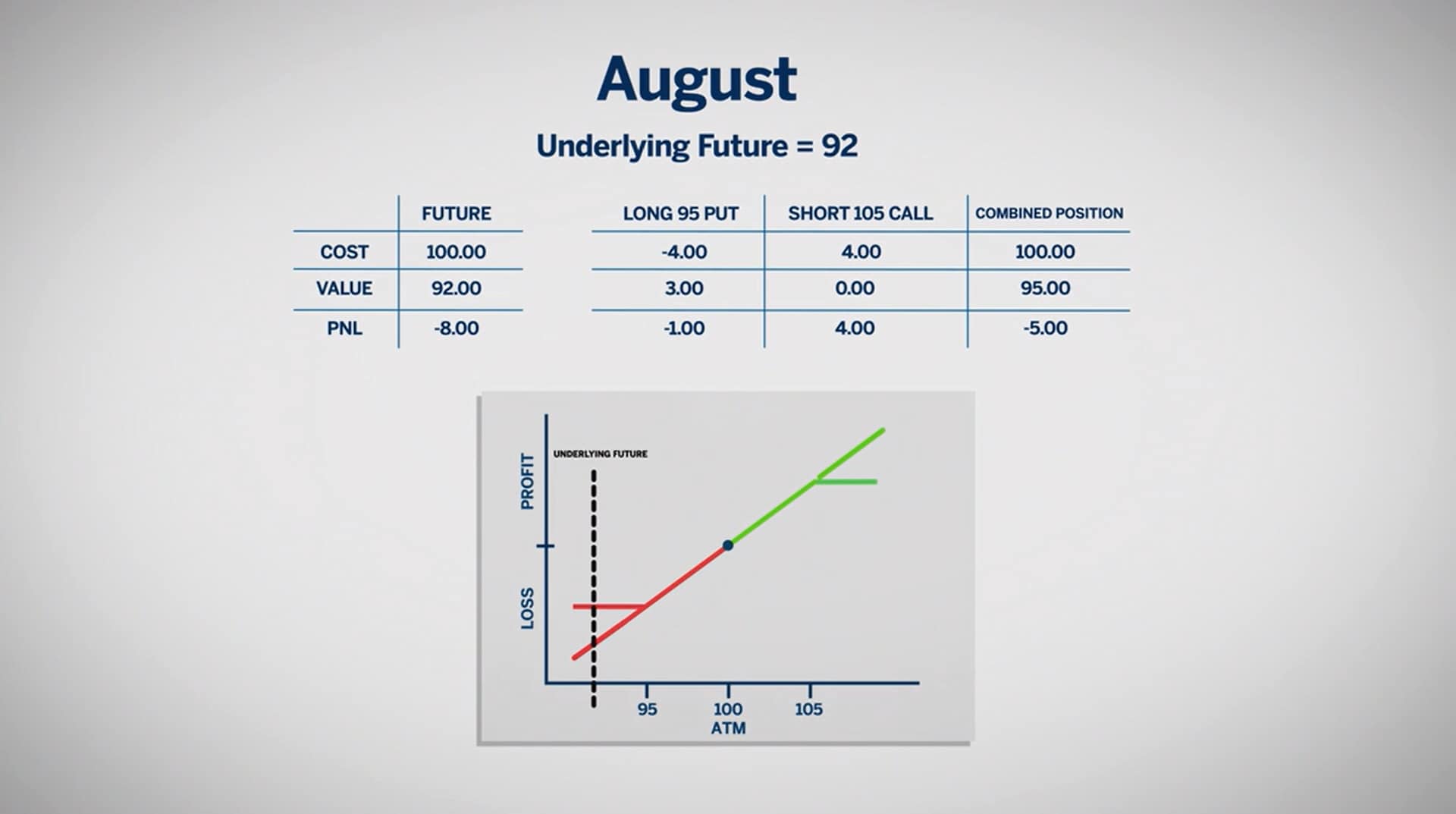

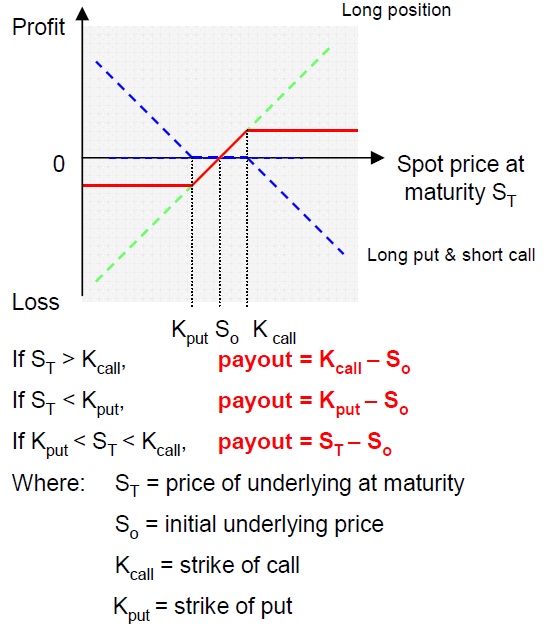

Bunker collars, Swaptions, Case 1: Zero-cost collars, Case 2: Participating collars - Freight Derivatives and Risk Management in Shipping

Javier Blas on Twitter: "The details of the Occidental Petroleum three-way cost-less collar hedge structure for 2020 (plus selling call options in 2021) via company's slides. A big hedge of 330k b/d (

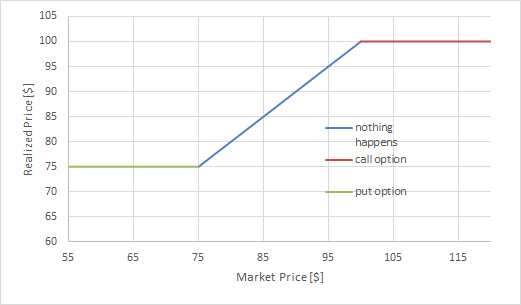

![PDF] Hedging of Sales by Zero-cost Collar and its Financial Impact | Semantic Scholar PDF] Hedging of Sales by Zero-cost Collar and its Financial Impact | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/11bf436a637c92a60fc702958093ae44d11f2009/7-Figure2-1.png)

/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

![PDF] Hedging of Sales by Zero-cost Collar and its Financial Impact | Semantic Scholar PDF] Hedging of Sales by Zero-cost Collar and its Financial Impact | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/11bf436a637c92a60fc702958093ae44d11f2009/2-Figure1-1.png)